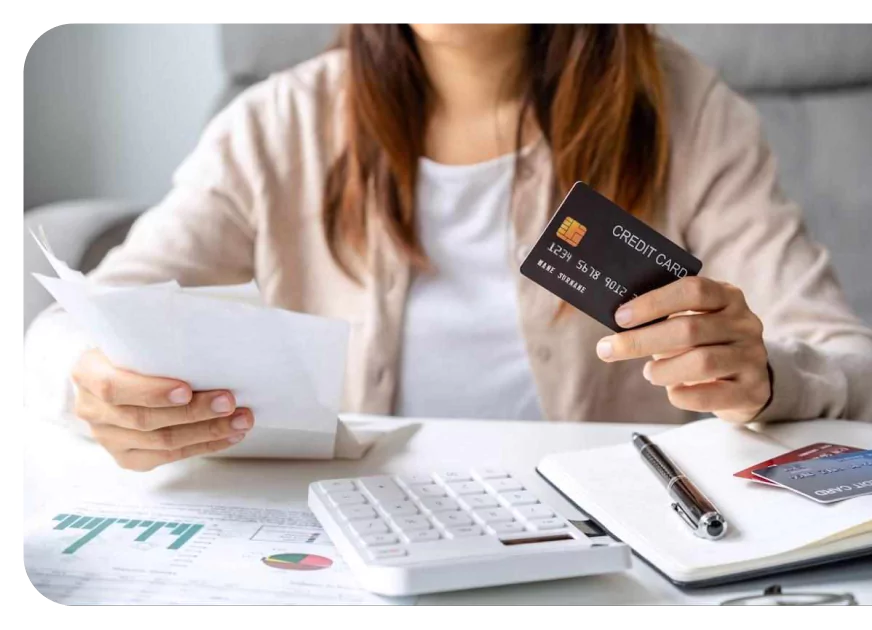

What is Surcharging?

Surcharging refers to the practice of adding an extra fee to a transaction, typically encountered in credit card transactions, to cover the costs associated with processing payments. Essentially, it shifts the burden of processing fees from the merchant to the customer, allowing businesses to recoup some of the expenses incurred in facilitating electronic payments. This fee can either be a percentage of the transaction amount or a flat fee, depending on the merchant's preference and the regulations governing surcharging in their jurisdiction.

When done properly, surcharging can save businesses upwards of 95%, or even more, which can equate to thousands, or even tens of thousands of dollars, in savings.

However, surcharging is not universally permitted. Many countries and states have laws and regulations governing its use, and in certain areas, it may be prohibited entirely or subject to strict conditions. Therefore, businesses considering surcharging must thoroughly research and adhere to the legal framework in their region.

Learn MoreWhat Does Cash Discount And Surcharging Processing Mean For Your Business.

EZ2 Payment offers programs for business owners to help save you money on processing fees. One of the most popular programs for helping businesses cut down on their processing costs are cash discount and surcharging programs. There’s typically a fee for using a credit card, and the ability to offer a discount for cash payments has actually helped many business owners save more money than they initially thought.

Cash Discount

What is a cash discount? A cash discount is a great way for you and your customers to save money. When you list your prices, only state the credit card price, then offer a discount to people who pay with cash.

Surcharging Fees

What are surcharging fees? If your business posts “cash only” prices, then the surcharging fee is placed on orders that are paid for by credit card.